Investor FAQ

Operation

|

Q: A: |

Production Sharing Contract (PSC), how does it work?

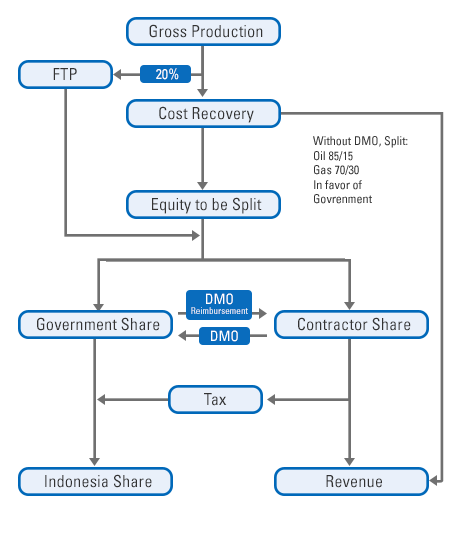

An original PSC is awarded to explore for and to establish commercial production. The PSC is usually awarded for a period of 30 years, subject to discovery of commercial quantities of oil and gas within a certain period. In each PSC, the contractor and SKK Migas share the total production in any given period in a ratio agreed between the two under the terms of that PSC. The contractor generally has the right to recover all funding and development costs, as well as operating costs, in each PSC against available revenues generated by the PSC after deduction of first tranche petroleum (“FTP”). All PSCs in Indonesia are sublect to DMO under which the contractor is required to supply, at a reduced price, usually 25% of market price. |

|

Q: A: |

What is MedcoEnergi International competitive advantage? MedcoEnergi’s competitive advantage is with its knowledge in maintaining mature fields production and lengthening the productivity of its assets as well as having a very close relationship with the government of countries in which the Company operates. |

|

Q: A: |

How will MedcoEnergi manage its reserve replenishment ? The Company will undertake three strategies in improving/replenishing the reserves which are: 1. Acquired more fields that fit in the niche market in which the Company operates 2. Maintain our exploration program. 3. Enhance the current portfolio by drilling new wells and using technology to boost reserves and production. |

|

Q: A: |

What is MedcoEnergi's expected oil & gas production? We aim to maintain the same level of oil and gas production at 85 mboepd, which is quite prudent considering MedcoEnergi's daily production capacity is around 100 mboepd. |

|

Q: A: |

MedcoEnergi E&P operating cost? Our current blended oil and gas lifting cost is still below US$10/barrel oil equivalent (BOE). We aim to maintain our operating costs <US$10/BOE at least until 2020. |

|

Q: A: |

What is MedcoEnergi’s strategy to maintain future growth? For the next five years the company will focus its effort in delivering its under development assets which will drive the company’s mid and long-term underlying growth. These assets includes: 1. Phase 2 of Senoro gas field development in Senoro-Toili block PSC-Joint Operating Body (JOB), Central Sulawesi; 2. Block A gas fields in Block A, Aceh; 3. Off-shore oil exploration and development in South Natuna Sea Block B; 4. International oil project in Area 47 Libya. Aside from these developments, the Company will also look into acquisition opportunities in the oil and gas industry as well as doing explorations to prove more reserves for future developments. |

|

Q: A: |

What is the latest status on Medco Power Indonesia? MedcoEnergi currently holds majority ownership at 88% shares in Medco Power Indonesia together with its partner International Finance Corporation (IFC) who owns 12% shares. MedcoEnergi believes electricity remains an attractive business and can provide added value to the Company in the future by pursuing new projects such as:

|

|

Q: A: |

Who are the founders of the Company? The Panigoro Family, with Mr. Arifin Panigoro acting as the patriarch, started the company as a drilling service company back in 1980. The family has other businesses outside the oil and gas sector such as forestry and plantation, fabrication, property, etc. |